The Importance of Voir Dire in Criminal Trials is crucial for securing fairness in RF Securities cases, a vital aspect of industry regulation. This process meticulously scrutinizes potential jurors, ensuring unbiased and representative juries to prevent wrongful accusations and maintain public trust. Effective Voir Dire exposes biases related to financial practices and regulatory bodies, allowing attorneys to select impartial jurors critical for just outcomes, particularly in complex securities litigation. Its strategic value lies in enhancing defense strategies and upholding the integrity of criminal proceedings within the financial sector.

The RF Securities industry, a cornerstone of global financial markets, operates under stringent regulations. Understanding and effectively navigating these rules, particularly during criminal trials, is paramount. This article delves into the intricate world of RF Securities Industry Regulation, with a focus on the pivotal role of voir dire. We explore its significance in ensuring fair trials, its challenges, best practices, and how it has shaped outcomes in real-world cases involving financial crimes, underscoring the importance of voir dire in criminal trials.

- Understanding RF Securities Industry Regulation: An Overview

- The Role of Voir Dire in Ensuring Fair Trials within the Securities Sector

- Challenges and Best Practices in Conducting Voir Dire for Criminal Cases Involving Financial Crimes

- Case Studies: How Effective Voir Dire Has Shaped Outcomes in RF Securities Trials

Understanding RF Securities Industry Regulation: An Overview

The RF Securities Industry Regulation is a crucial aspect of maintaining integrity and fairness in financial markets. It involves a complex web of rules and guidelines designed to protect investors, ensure market stability, and prevent fraudulent activities. This regulatory framework encompasses various sectors, including banking, brokerage, and investment management, with the primary goal of fostering transparency and accountability. By implementing robust regulations, authorities aim to create a level playing field for both corporate and individual clients, thereby enhancing market trust and confidence.

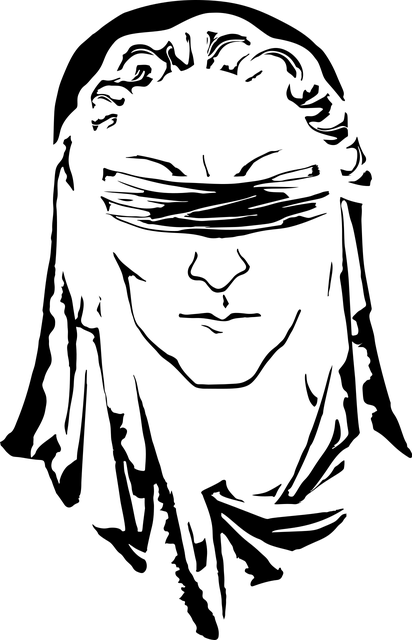

One integral component of this regulatory landscape is Voir Dire, a critical process in criminal trials that involves the careful examination of potential jurors. This method ensures that jury trials remain unbiased and representative, which is essential for delivering just outcomes. By rigorously applying Voir Dire, legal systems can avoid indictment scenarios where individuals are wrongly accused. This practice underscores the importance of due diligence in selecting fair and impartial juries, reflecting a balanced approach to criminal proceedings within the securities industry regulation framework.

The Role of Voir Dire in Ensuring Fair Trials within the Securities Sector

The process of voir dire plays a pivotal role in ensuring fairness and impartiality within criminal trials, particularly in the securities sector where complex financial cases are prevalent. This meticulous procedure involves careful questioning and selection of jurors to identify any biases or prejudices that might impact their ability to render an unbiased verdict. By delving into potential biases related to white-collar and economic crimes, voir dire helps avoid indictment and ensures a fair arena for both prosecution and defense.

An effective voir dire process is crucial for winning challenging defense verdicts. It allows lawyers to uncover hidden prejudices that might influence the jury’s perception of financial cases. This strategy is especially vital in navigating complex securities litigation where economic crimes can be intricate and subtle. Through thoughtful questioning, attorneys can identify jurors who possess the impartiality and discernment necessary to deliver a just outcome, thereby strengthening the defense strategy.

Challenges and Best Practices in Conducting Voir Dire for Criminal Cases Involving Financial Crimes

Voir dire plays a pivotal role in ensuring fairness and impartiality in criminal trials, especially for financial crimes cases. The process allows judges to carefully select jurors who can objectively evaluate the evidence presented during trial, which is crucial given the intricate nature of financial fraud. However, conducting effective voir dire in these complex cases presents several challenges. One significant hurdle is uncovering potential biases or preconceptions related to topics like banking practices, regulatory bodies, and legal penalties, which might not be immediately apparent. Jurors may hold implicit beliefs that could influence their perception of the case, making it essential for attorneys and judges to ask insightful questions tailored to these financial matters.

Best practices in conducting voir dire involve strategies such as using clear and concise language to explain technical concepts, providing hypothetical scenarios relevant to the case, and encouraging open dialogue with potential jurors. Lawyers should also be prepared to address misconceptions about financial crimes, ensuring a comprehensive understanding of the legal processes involved. By employing these techniques, the process becomes more efficient, allowing for a qualified jury that can reach an unbiased verdict. Ultimately, the importance of voir dire in criminal trials cannot be overstated, especially when dealing with serious financial offenses, as it helps secure a complete dismissal of all charges and ensures justice is served in the most transparent manner possible within the respective business environment.

Case Studies: How Effective Voir Dire Has Shaped Outcomes in RF Securities Trials

Voir dire plays a pivotal role in shaping the outcomes of RF securities trials, acting as a crucial filter to ensure impartial and competent juries. Through this meticulous process, judges carefully select jurors who can set aside personal biases and provide unbiased assessments of complex financial evidence. Effective voir dire has been instrumental in achieving winning challenging defense verdicts for his clients, highlighting its importance in navigating the intricate landscape of securities litigation.

Case studies illustrate how well-conducted voir dire sessions can expose potential biases and prejudices among prospective jurors. By delving into their backgrounds, experiences, and financial knowledge, attorneys can uncover hidden influences that might affect their judgment. This strategic approach not only strengthens the defense strategy but also fosters trust in the legal system by ensuring that decisions are based on merit, rather than preconceived notions or external pressures from the philanthropic and political communities.

The regulation of the securities industry is a complex web, but at its heart lies voir dire as a pivotal tool for ensuring justice. This article has explored the multifaceted role of voir dire in the context of RF Securities Industry Regulation, demonstrating its importance in uncovering potential biases and ensuring fair trials. From understanding the regulatory overview to examining best practices in financial crime cases, it’s clear that effective voir dire is essential to the integrity of criminal trials. By carefully considering these strategies, legal professionals can navigate the complexities of securities litigation, fostering a more just and equitable system.